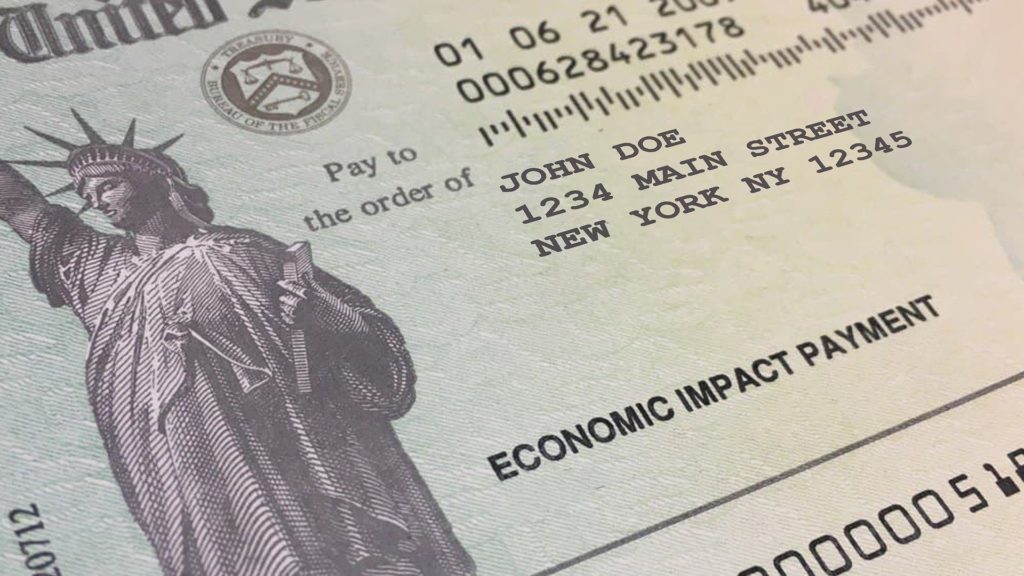

Congress passed a COVID-19 relief bill that offers stimulus payments as economic relief nationwide. Here are questions related to the stimulus payments to help you know the facts.

FAQ’s

Will I get a check?

This depends on your income and status.

Income: If you make $75,000 or below as an individual, you will receive the full check. If you make less than $80,000, you will receive a partial amount. For heads of household, it is $112,500, and if you file jointly, the threshold is $150,000.

Status: You must have a Social Security number to be eligible.

How much is a check?

The full amount is a one-time payment of $1,400. If you make more than $75,000 but less than $80,000, it will be less.

When will I receive my check?

Once the bill is signed, it can take anywhere from a few days for the first people to receive the money to a few weeks. You can track the status of your payment by going to the IRS tool here.

How will my check be delivered?

If you have a direct deposit set up with the IRS, you will receive a direct deposit. If you don’t, you will receive a check in the mail.

You can go here for a useful calculator.

How will they determine my income?

They will determine your income based on the latest tax return you submitted. If you submitted your FY2020 tax return already, the IRS will use that to determine your eligibility. If you haven’t submitted your tax return yet, they will use FY2019’s records.

What if I made more money in FY2020 than FY2019 but haven’t filed my tax return yet? Will I have to return the money?

It is okay. You will receive the money and you won’t have to return the money.

Are college students who are claimed as dependents eligible?

Yes, but their parents who claim them will receive the check.

Do older relatives who live with us count as eligible dependents?

Yes, unlike other stimulus checks, if they are claimed as dependents, the taxpayer who claims them will receive a check.

What if I am newly eligible for a stimulus payment based on my 2020 income, but I haven’t filed my 2020 return?

The New York Times says, “You could try to file it quickly, in hopes of receiving your payment faster. But there’s no guarantee your return will be processed quickly enough, and haste can lead to errors.

And you don’t have to rush: The bill includes a provision for the Treasury Department to make supplemental payments by September. If you don’t get one then, you can claim the $1,400 when you file your 2021 taxes.”

If I have a baby anytime in 2021 and meet the income qualifications, will I get a $1,400 payment for the child, too?

Yes. Any baby born in 2021 or before is eligible.

What should I do if I still haven’t gotten a payment from a past round of stimulus?

The New York Times says, “If you were in fact eligible to receive it, you can try to recover it through the so-called Recovery Rebate Credit when filing your 2020 return. Make your claim on Line 30 of Form 1040 or 1040-SR.